How To's

How to Franchise Your Business–The Ultimate Guide

Published

5 years agoon

By

Peter Bolic

Are you a business owner interested in learning how to franchise your business? Are you an entrepreneur considering starting your own business with franchising in mind? If you answered yes to either question, this is guide is for you. We break down how to franchise your business and highlight the most important steps. This is the ultimate guide on how to franchise your business.

I. How to Franchise Your Business – The Background

A. What is a franchise?

We’re all familiar with franchises. Many of America’s largest corporations are franchises. We can all probably name five or six without blinking. McDonalds, Burger King, Taco Bell, Ace Hardware, Serve Pro. But what exactly is a franchise? How do companies get to that stage? How do you franchise your business? This article is the ultimate breaks it all down and gives you the ultimate overview on how to franchise your business

Legally, the term “franchise” does not have one uniform definition. Many federal and state franchise laws share common definitional approaches, but there’s no one answer. What qualifies as a franchise under federal law may not qualify under a particular state’s laws. A franchise in one state may not be a franchise in all states.

Fundamentally, a franchise is defined by the coexistence of three elements:

The right to use a trademark. This element involves a grant of rights to use another’s trademark to offer, sell, or distribute goods or services. While not every trademark license creates a franchise, every franchise has some form of trademark license.

The right to use a marketing system. Depending on the jurisdiction, this element takes one of three variations, but all focus on the licensor’s assistance with or control over the licensee’s entire method of operation causing the public to regard all licensed outlets as a unified marketing concept. In some states, the required assistance or control may take the form of a prescribed marketing plan or what some jurisdictions more broadly describe as a “community of interest.”

The existence of the first two points in exchange for a fee. This element involves payment of a required fee by the licensee. Franchise status hinges entirely on whether an arrangement meets the applicable statutory definition.

A business cannot avoid a franchise relationship simply by disclaiming its existence. If the specific elements coexist, the relationship is a franchise. This is true even if the parties do not refer to the relationship as a franchise.

B. What laws govern franchises and the franchise relationship?

Franchises are governed by both federal and state laws. These law take the form of disclosure laws, registration laws, and relationship laws.

i. Disclosure laws

Disclosure laws are pre-sale laws that govern the franchisor’s conduct in making franchise sales. These laws are designed to prevent franchisors from making material misrepresentations to entice consumers into a franchise system.

(a) Federal Disclosure Law – The Amended Franchise Rule

Perhaps the most recognizable disclosure law is the Federal Trade Commission’s Franchise Rule. The FTC’s Rule on Franchising was enacted in 1979.

The FTC enacted the Franchise Rule in response to a boom in the franchise industry after World War II. During that time there were significant instances of fraud in connection with the offer and sale of franchises. The 1979 Rule required pre-sale disclosure and prohibited certain practices the FTC deemed unfair or deceptive in nature. The FTC’s goal was to provide the minimum information needed to make an informed decision to enter into the franchise relationship.

In 2007, the Rule was amended to clarify points of ambiguity and adjust to changes in technology.

The form of disclosure prescribed by the Franchise Rule is referred to as a “Franchise Disclosure Document” (“FDD”).

The FDD consists of 23 “Items” covering a variety of subjects. In addition, each FDD must contain copies of all material contracts a franchisee must sign. This includes the franchise agreement and any other agreement the franchisor arranges for the franchisee. The franchisor must also include its financial statements, and other key information. Franchisors are solely responsible for ensuring the adequacy and accuracy of the information included in the FDD.

Franchisors must give each prospective franchisee their FDD at least 14 calendar days before closing a franchise sale. The franchisor cannot count the day it delivers the FDD to the prospect or the 14th day after receipt of the FDD. In essence, this means that a total of 16 calendar days must pass between FDD delivery and the prospect signing.

If the information disclosed in the FDD changes materially before the end of the fiscal year, the franchisor must update the FDD when the material change occurs. The FTC defines a “material change” is one that is likely to affect a prospective franchisee’s investment decision, and should be viewed through the lens of a prospective franchisee. The FTC’s Compliance Guide, material changes include events such as bankruptcy filings and the filing of legal actions against the franchisor that could negatively impact the franchisor’s financial condition.

(b) State Disclosure Laws

All franchise transactions in the US are governed by the Franchise Rule. Some are also governed by state disclosure laws as found in these 15 states:

| California | Hawaii | Illinois | Indiana | Maryland |

| Michigan | Minnesota | New York | North Dakota | Oregon |

| Rhode Island | South Dakota | Virginia | Washington | Wisconsin |

Of these states, all but Oregon also have registration laws (described below).

Under federal and state law, a franchisor must update its FDD annually (typically within 90 to 120 days of the end of its fiscal year) with new information affecting the franchise from the previous calendar year.

To comply with disclosure requirements applicable to the transaction, parties must identify and evaluate any applicable state disclosure laws, which differ by state. For example, some states have broadly written disclosure laws, so that a franchisor must register if any of these circumstances exist the prospective franchisee:

• lives in the state.

• plans to open the franchised business there.

• has a place of business in the state.

Some states instead have disclosure laws that apply to a more limited set of circumstances. Others do not have disclosure laws, but instead have business opportunity laws written broadly enough to apply to franchisors.

Most of these business opportunity laws specifically exempt franchise offerings, but only if the franchisor complies with the disclosure requirements under the Franchise Rule. As a result, these business opportunity laws, while not franchise disclosure laws, contain enforcement mechanisms to ensure that franchisors that sell franchises in the state comply with the Franchise Rule.

ii. Registration laws

Like disclosure laws, registration laws are pre-sale laws. Fourteen states have registration laws and all states that have disclosure laws, with the exception of Oregon, also have registration laws.

There is no federal registration law. As a result, franchisors that comply with the Franchise Rule’s disclosure requirements can sell in states that do not require registration without having to file their document with any governmental authority.

Under the vast majority of state registration laws a franchisor must:

- register in the jurisdiction before offering to sell or selling franchises in the jurisdiction by filing its FDD and application forms with the jurisdiction’s applicable regulatory agency; and

- The NASAA issues standard forms that most jurisdictions follow.

- renew its registration annually.

If a franchisor is not registered in the relevant jurisdiction, a franchisor typically cannot either:

- offer to sell a franchise in the registration jurisdiction; or

- sell a franchise in the registration jurisdiction.

To ensure that they comply with registration requirements applicable to the transaction, parties must identify and evaluate any applicable state registration laws.

Registration laws differ by state and it is possible that more than one state’s registration laws apply to a given transaction. For example, some states have registration laws that:

- Are written broadly, so that a franchisor must register if:

- the prospective franchisee lives in the state;

- the prospective franchisee plans to open the franchised business in the state; or

- the franchisor has a place of business in the state.

- Apply to a more limited set of circumstances.

iii. Relationship laws

Relationship laws are post-sale laws that apply only after a franchisee has purchased a franchise and the parties have begun their contractual relationship.

While there is no federal franchise relationship law, 22 states and two territories have franchise relationship laws:

| Arkansas | California | Connecticut | Delaware |

| Hawaii | Idaho | Illinois | Indiana |

| Iowa | Kansas | Michigan | Minnesota |

| Mississippi | Missouri | Nebraska | New Jersey |

| North Dakota | Rhode Island | South Dakota | Virginia |

| Washington | Wisconsin | US Virgin Islands | Puerto Rico |

Relationship laws can govern a variety of post-sale conduct by the franchisor.

Many relationship laws prohibit a franchisor from terminating or refusing to renew a franchisee unless the franchisor either:

- Fulfills specific conditions; or

- Offers to compensate the franchisee for the termination or non-renewal.

These laws may:

- Prohibit discrimination (preferential treatment) between similarly situated franchisees;

- Prevent a franchisor from restricting the venue for legal disputes between the parties to locations outside the state;

- Prohibit franchisors from terminating franchisees’ contracts without giving the franchisees notice and a statutorily-mandated period to cure a default.

To ensure that they comply with relationship requirements applicable to the parties’ relationship with one another, the parties must identify and evaluate any applicable and likely varying state relationship laws.

D. The accidental franchise

Many businesses around the country unknowingly operate franchises every year. The operation is extremely problematic in light of the above-referenced state and federal laws a franchisor must comply with. Any business that meets the franchise definition, but fails to comply the above regulations exposes itself to significant liability.

Trademark License + Marketing System + Fee = Franchise

The most common method accidental franchise claims arise is a distribution or licensing arrangement falls short of the distributor’s or licensee’s expectations or the licensor terminates the contract without cause as permitted by the parties’ contract.

In some cases, accidental franchise claims are brought by unhappy licensees, distributors, or dealers to prevent a licensor or supplier from imposing network-wide changes. Accidental franchises are also exposed in the due diligence process that accompanies the sale of a company or strategic investment by private equity or venture capital firms.

So what are the dangers of not complying with applicable franchise laws?

Franchise law violations carry significant penalties even when the inadvertent franchisor neither knew about the law nor intended to violate it. Not only is it a felony to sell a franchise without complying with franchise sales law, but federal and state agencies have broad powers to penalize franchise law violators, including by:

- Freezing their assets.

- Ordering restitution to the franchisee.

- Issuing cease and desist orders.

- Banning them from selling franchises.

- Assessing substantial fines.

Franchisees also have private remedies for state franchise law violations. Some laws permit franchisees to recover compensatory damages and also treble damages, lost profits, and attorneys’ fees.

An injured franchisee may also:

- Rescind a franchise agreement for disclosure and registration violations.

- Obtain an injunction to stop the wrongful termination or nonrenewal of a franchise.

- Recover damages or restitution.

State franchise laws impose joint and several personal liability on the franchisor’s management and owners even when the franchisor is a legal entity.

While the federal franchise law does not provide franchisees with a private right of action, injured franchisees can find remedies under many state unfair trade practices laws by relying on violation of the federal franchise law as the predicate unfair practice.

Counsel overlooking franchise laws may also be guilty of malpractice and potentially liable to victims of their clients’ wrongdoing.

II. Creating a Franchise – The Leg Work

A. The three pieces to the franchise puzzle

Trademark license + Marketing System + Fee = Franchise = you need an FDD.

Examining the puzzle–

Trademark License

No formal license is required. A franchisor must simply grant to the franchisee the right to use the franchisor’s trademark or other commercial symbol. We’ll dig deeper in a moment.

Marketing System

The franchise seller will exert or have the authority to exert a significant degree of control over the franchisee’s operations or provide significant assistance in the franchisee’s method of operation. The marketing or operations piece is typically addressed by a franchise consultant that creates or solidifies an “Operations Manual” and marketing materials on behalf of the franchisee. (E.g. Franchise Creator, SMB Advisors, and iFranchise).

Fee

The franchisee makes a required payment or commits to make a required payment, directly or indirectly for an amount greater than $570 during the first six months of operations.

B. Entity formation considerations

i. Sole proprietorships and general partnerships

Sole proprietorships are the worst legal structure for franchises. While sole proprietorships offer benefits for small businesses for their tax structure, they do not offer protection from individual liability.

The reason for this is sole proprietorships and general partnerships are not separate from a franchisee’s personal legal identity.

Accordingly, any claims brought against the franchise would create enormous liability.

ii. Limited Liability Company

LLCs tend to be the best bet for startup franchisors. The entity form shields against individual liability while providing significant tax benefits. LLCs can be designated as flow-through entities, which means no corporate income tax returns need to be filed – all net income is taxed at the individual level.

That said, LLCs offer somewhat limited flexibility as independent legal entities and have few statutory requirements governing them. They do not offer much for a franchise with equity investors. Franchises under LLCs run into challenges when issuing equity to investors because they are not distributed in the same structure as corporations. If a franchisee has multiple investors into a franchise, LLCs become more complex from a tax perspective.

iii. C-Corporations

C-corps are more ideal for large, established franchisors, primarily for their equity distribution for investors. This legal structure is most commonly used for publicly traded companies with several equity investors and executive boards. They are also troublesome for startup franchisors because C-corps are taxed at both the corporate and individual levels. The goal of any C-corp structure is to position a business for future growth by soliciting additional capital investment from investors.

That said, if a startup franchisor anticipates rapid growth, C-corps could be an ideal structure to reduce tax costs. But for those just starting, this is not an ideal structure.

C. Intellectual Property considerations

i. Trademarks

It is difficult to overstate the importance of trademarks to franchising given the FTC’s definition of a “franchise” under the Amended Rule. It comes as no surprise that franchisors need to protect their mark regardless at all times. Notwithstanding, this is an especially important consideration in formation. Ensuring that a franchisor’s marks are protected at the outset is great way to insure against future litigation issues.

(a) What Does Trademark Protect?

The Lanham Act purposefully describes the universe of things that can qualify as a trademark in the broadest sense to include “any word, name, symbol, or device, or any combination thereof.”

Over the years the definition has expanded to include everything from a particular bottle shape to the scent of sewing thread. Even a particular identifying sound or jingle now qualifies as trademarks or service marks.

Trademarks are marks that are tied to a product, whereas “service marks” serve to identify the services a business provides.

(b) Eligibility for Trademark Protection under Applicable Law

The Lanham Act defines federal trademark protection and trademark registration rules. The Lanham Act grants the United States Patent and Trademark Office (“USPTO”) administrative authority over trademark registration.

For a given Mark to be eligible for trademark protection in the United States, that Mark must be: (1) distinctive or capable of acquiring distinctiveness with respect to the goods and/or services that franchisor uses (or intends to use) the Mark in connection with; and (2) used in U.S. commerce in connection with those goods and services, except in very specific situations. Assuming a franchisor’s mark meets these criteria, the franchisor should register its trademark prior to sale.

The importance carries over to the FDD. Specifically, for each principal trademark, a franchisor must include information regarding its registration status with the United States Patent and Trademark Office (“USPTO”). A franchisor must also include any limitations on the franchisee’s use of the mark, whether the franchisor knows of any superior prior rights or infringing uses that could materially affect the franchisee’s use of the principal trademarks in the state where the franchised business will be located, and whether the marks have been contested (such as in any court action or administrative proceeding).

ii. Copyrights

Copyrights play a slightly less vital role in the franchising process. The U.S. Copyright Office, quoting the U.S. Copyright Act (the “Copyright Act”), sets forth the following as the primary categories of copyrightable works:

| Type | General Examples | Franchise-Specific Examples |

| Literary works | Book entitled “The Pelican Brief” by John Grisham | Operations Manual; source code to proprietary point-of-sale(“POS”) software |

| Musical works(and words thereto) | The hit song “Whatever It Takes” by ImagineDragons | Mister Softee Jingle |

| Dramatic Works | Shakespeare’s “Romeoand Juliet” | Taco Bell’s new “NachoFries” commercials. |

| Pantomines and other choreographic works | Ice Skating Routine Performed at the Winter Olympics | Fitness concept’s training instruction made available via online streaming |

| Pictorial, graphic and sculptural works | Painting entitled “Mona Lisa” by Leonardo da Vinci | Mascots; trade dress |

The Copyright Act does not have overly strict definitions regarding what falls within the scope of each “type” of copyrightable work, and the Copyright Office even advises applicants that these categories should be viewed broadly when filing a copyright application. For example, computer system programs franchisors develop for exclusive use in connection with their System (such as the POS System source code) might be registerable as a “literary work,” notwithstanding the fact that source code is not the next great American novel.

Importantly in the franchising context, copyright law does not protect names, short phrases and slogans (such as “taglines”), product lettering and/or coloring and, perhaps most importantly, a mere listing of product ingredients or contents (which may apply to franchisor’s list of required purchases and/or approved suppliers).

Even if a franchisor client’s list of ingredients contained in a given menu item is not likely protectable, however, the proprietary recipe detailing how to make that menu item might be (assuming it is more than putting typical burger ingredients on a bun).

At the same time, brand names, slogans and phrases that most franchisors really rely upon to drive their brand are potentially protectable under trademark law, subject to the analysis discussed elsewhere in this paper.

iii. Patent Protection

Patent protection typically plays an even smaller role than copyright in the franchising process. Franchisors rarely rely on patent ownership as part of their IP arsenal as the core “trade secrets” and other “proprietary” information that comprise the System are typically licensed to their respective franchisee by way of trademark or copyright.

D. Drafting the franchise agreement and FDD

i. The Key Franchise Agreement Provisions

(a) Fees

Profit and administrative fees:

These fees:

- Give companies the incentive to start and continue franchising.

- Set the franchisee’s expectation that the franchisor will likely share in the income of the individual franchised business.

- Help pay for the franchisor’s administrative infrastructure used to support its franchisees and franchise system.

There are three types of profit and administrative fees:

- Initial franchise fees

Prospective franchisees pay initial franchise fees to the franchisor for the privilege of entering into the franchise relationship. Typically made in a lump sum and disclosed in Item 5 of the FDD, the amount:

- Is usually large enough to signify the franchisee’s commitment to build the business and learn the franchise system.

- May have some component of profit built in, but in most circumstances the franchisor uses the initial franchise fee to cover its costs to locate and train new franchisees.

- Usually helps new franchisors cover their significant start-up costs.

- Royalty fees

Royalty fees are typically ongoing fees that a franchisee must pay the franchisor during the life of the franchise relationship. They are usually expressed as either or a combination of:

- A percentage of the franchisee’s gross revenue.

- A flat fee.

Royalty fees are usually paid weekly or monthly, but in rare instances are paid quarterly or annually. The amount of the royalty fee is disclosed in Item 6 of the FDD.

- Successor or transfer fees

Under the franchise agreement, the franchisor typically reserves the right to assess either or both:

- Successor fees. These fees compensate the franchisor if and when the franchisee decides, at the end of its term, to continue in the franchise relationship, typically by entering into a successor franchise agreement (also referred to as renewing and renewal fees).

- Transfer fees. These fees compensate the franchisor if and when the franchisee transfers, sells, or assigns its rights under the franchise agreement to a third party.

- Successor and transfer fees are ordinarily charged as either:

- A fixed fee.

- A percentage of the initial franchise fee that the franchisor is charging new franchisees at the time that the franchisee obtains the successor franchise or transfers the franchise to a third party.

Successor franchise and transfer fee amounts are disclosed in Item 6 of the franchisor’s FDD.

Service Fees:

Depending on the franchise system used, franchisors charge franchisees service fees, including brand building fees, among others, for services provided.

- Brand Building Fees

Brand building fees are the most common of service fees. These fees are charged by a franchisor for the purpose of creating or increasing brand awareness. These fees have different names, including:

- National advertising fund.

- Marketing fund.

- Brand awareness fund.

- Brand fund.

Regardless of the name, the fee usually works the same way:

- The franchisee pays the franchisor either or a combination of both:

- a percentage of its gross revenues; or

- a flat fee on a weekly or monthly basis.

- The franchisor:

- aggregates all of these payments across the franchise system into a common fund; and

- spends the money in the fund to advertise the franchise system locally, regionally, or nationally.

In most cases, the franchisor:

- Does not make any guarantees or promises to its franchisees that it will conduct advertising or brand awareness activities in a way that ensures that each individual franchisee will benefit directly or indirectly from the fund.

- Usually retains complete discretion over how the funds are spent, although some franchise systems use a council of franchisees to help direct advertising.

- Reserves the right to use a specified portion of the money paid into the advertising fund to pay its own internal administrative expenses that relate specifically to its advertising or brand-building activities.

The amount of the required brand building fund payment is disclosed in Item 6 of the franchisor’s FDD. The specific ways that the franchisor uses or intends to use the brand building fund are disclosed in Item 11 of the franchisor’s FDD.

Other Service Fees:

Franchisors also charge a fairly wide variety of other service fees, including those that are related to a specific service that the franchisor requires its franchisees to pay for and use. These fees include:

- Technology fees

Typically, fees paid to license proprietary software or technology or to maintain and update a system-wide website.

- Customer relationship management fees

Paid for the franchisor to manage or administer a system-wide program for customer service.

- Fees paid for the franchisee to attend national meetings or conventions

These fees are disclosed in Item 6 of the franchisor’s FDD.

Expense Reimbursement and Cost Recovery Fees:

Expense reimbursement and cost recovery fees are designed to reimburse the franchisor for expenses and costs that it might incur over the life of the franchise relationship in supporting or focusing on the franchisee. These typically include:

- Indemnification fees

The franchisee pays indemnification fees when the franchisor requires the franchisee to hold harmless or indemnify the franchisor for claims relating to franchisee’s operation of the franchised business.

- Attorneys’ fees and costs after dispute is resolved

Most franchise agreements have a “loser pays” attorneys’ fees provision. A minority of agreements have a non-reciprocal fee provision requiring the franchisee to pay the franchisor’s attorneys’ fees if the franchisee loses in a dispute.

- Audit fees

The franchisor typically reserves the right to audit the franchisee to ensure the franchisee is accurately reporting gross revenue. If the franchisee underreports gross revenue, the franchisor often charges the franchisee for the audit costs.

- Legal fees and administrative costs

These are assessed if the franchisee does not timely pay the franchisor amounts owed or breaches another provision of the franchise agreement that requires the franchisor to take administrative action or use legal counsel to provide notice of the breach.

- Interest and late fees.

These fees are assessed if the franchisee’s payments owed to the franchisor are not paid in a timely manner.

- Management or step-in fees.

In most systems, the franchisor retains the right to step into the franchisee’s shoes and temporarily manage, operate, or terminate the franchised business if the franchisee:

- dies;

- becomes temporarily or permanently incapacitated; or

- commits a material default that has remained uncured.

- Step-in or management rights typically last for a fixed duration and are charged in a specified dollar amount per day that the franchisor operates the franchised business.

- Insurance

The franchisor typically has the right (but not the obligation) to obtain insurance on behalf of its franchisee if the franchisee fails to purchase insurance for itself. The franchisor typically charges a fee to cover its expenses of making these arrangements for the franchisee.

- Income tax reimbursement

An increasing number of states are now taking the position that if a franchisor has a franchisee located in the state, the franchisee’s presence in the state gives a sufficient economic nexus to charge income taxes to the franchisor based on the income earned from the franchisees in that state. Some franchisors in their franchise agreement retain the right to pass these income taxes to the franchisee, effectively requiring the franchisee to gross-up the amount paid to the franchisor, plus the amount of the income tax, so that the franchisee reimburses the franchisor for payments to the franchisee’s home state.

This list of expense reimbursement and cost recovery fees is illustrative and non-exhaustive. These fees are disclosed in Item 6 of the franchisor’s FDD.

(b) Territorial Provisions

Most franchise agreements grant to the franchisee a protected territory (sometimes known as a protected area, exclusive territory, territory, or area of operations). The franchisor often reserves to itself the right to conduct certain types of activities within the territory, such as:

- The right to sell products or services under the franchisor’s trademarks within the territory through alternative channels of distribution (which are methods of sale that are dissimilar to the business being franchised), such as:

- internet sales;

- mail order sales; or

- branded product sales through unaffiliated retailers or wholesalers.

- The right to operate, directly or through franchisees, franchised units at non-traditional locations, such as:

- airports;

- sport stadiums;

- military bases;

- hospitals; or

- schools.

- The right to operate, directly or through franchisees, businesses under trademarks other than the marks being franchised that may sell products or services that are similar or dissimilar to the products or services that will be sold by the franchisee.

(c) Non-Compete Provisions

Typically limited by geography and time, non-compete provisions prevent the franchisee from continuing to operate a similar business both before and after the franchise relationship ends. Some states have laws that prohibit or restrict the application of non-compete provisions after the termination, transfer, or expiration of the franchise agreement.

(d) Successor Franchise or Renewal Provisions

If a franchisee wishes to continue the franchise relationship after the end of the first term, the franchisor often requires the franchisee to:

- Sign the franchisor’s form of franchise agreement that it is then offering to new franchisees, which may include higher fees and a smaller territory, as well as other provisions that are materially different from those that are in the original franchise agreement.

- Remodel, update, or renovate the franchised business.

- Sign a general release of claims that the franchisee may have against the franchisor and its affiliates.

- Demonstrate that it has been in substantial compliance with the franchise agreement during the original term and that it has not been in default of the agreement more than a set number of times during the original term.

- Show that the franchisee has the right to continue at the same location under its lease or propose an alternative location.

- Demonstrate that the franchisee continues to meet the franchisor’s criteria for franchise operators.

- Pay a successor franchise fee that is charged as either:

- a fixed fee; or

- a percentage of the initial franchise fee that the franchisor is charging new franchisees at the time that the franchisee obtains the successor franchise or transfers the franchise to a third party.

Some state franchise relationship laws restrict a franchisor’s right to refuse to renew the franchise agreement, except under certain enumerated circumstances.

(e) Transfer Provisions

When a franchisee wishes to sell the franchised business to a third party, the franchisor often requires:

- The transferee (incoming franchisee) to sign the franchisor’s form of franchise agreement that it is then offering to new franchisees, which may include higher fees and a smaller territory, as well as other provisions that are materially different from those that are in the original franchise agreement.

- The transferee to remodel, update, or renovate the franchised business.

- The franchisee to sign a general release of claims that the franchisee may have against the franchisor and its affiliates.

- The franchisee to demonstrate that it has been in substantial compliance with the franchise agreement during the original term and that it has not been in default of the agreement more than a set number of times during the original term.

- The transferee to demonstrate that the transferee meets the franchisor’s criteria for new franchise operators.

- Pay a transfer fee that is charged as either:

- a fixed fee; or

- a percentage of the initial franchise fee that the franchisor is charging new franchisees at the time that the franchisee obtains the successor franchise or transfers the franchise to a third party.

Some state franchise relationship laws restrict a franchisor’s right to refuse a franchisee’s request to transfer the franchise agreement except under certain enumerated circumstances.

(f) Cooperative Advertising Provisions

These provisions require the franchisee, if it is within a geographic area where an advertising cooperative has been established, to contribute a fixed amount or percentage of the franchisee’s gross sales to the cooperative for the purpose of buying advertising that benefits all of the members of the cooperative.

(g) Automatic or Immediate Termination Provisions

Franchisors often retain the right to terminate the franchise agreement immediately, with or without notice to the franchisee, for certain types of franchise agreement violations. Automatic or immediate termination rights often include the right to terminate the franchise agreement for the franchisee’s:

- Insolvency or bankruptcy.

- Abandoning the franchised business.

- Underreporting or otherwise falsely reporting income to the franchisor.

- Misusing the franchisor’s confidential information, trade secrets, or intellectual property.

- Misrepresenting facts to the franchisor.

- Making an unauthorized transfer of the franchised business or its assets.

- Committing a felony or misdemeanor that is likely to reflect materially unfavorably on the franchisor or the franchised business.

- Failing to comply with applicable laws.

- Repeatedly defaulting under the franchise agreement, even if the defaults can be cured.

- Violating restrictive covenants.

- Selling products or services that have not been approved for sale by the franchisor.

Some state franchise relationship laws restrict a franchisor’s right to terminate the franchise agreement under certain enumerated circumstances.

(h) Termination with Opportunity to Cure

Franchisors usually have the right to terminate the franchise agreement if the franchisee commits a material default that remains uncured after a specified time, for example where the franchisee fails to:

- Make timely payments to the franchisor, its affiliates, or approved suppliers.

- Comply with the franchisor’s operations manual or other system standards.

(i) Dispute Resolution

Many franchise agreements require the franchisee and franchisor to first attempt to mediate any dispute between them before proceeding to litigation or arbitration. The franchisee should expect the franchise agreement to:

- Require arbitration for any disputes, as is common in most franchise agreements.

- Except franchisor actions for emergency, injunctive, or other provisional relief from any mandatory arbitration or mediation proceedings.

- Have a forum selection clause requiring any litigation to occur in its home city and state.

- Apply the franchisor’s home state laws as the agreement’s governing laws.

- Include jury trial, punitive damages, and class actions waivers.

The franchisee should note that any state franchise relationship laws limit the application of choice-of-law or forum-selection provisions, permitting the franchisee to litigate or arbitrate in the franchisee’s home state, under that state’s laws.

(j) Attorneys’ Fees Provisions

Most franchise agreements contain provisions for the unsuccessful party to pay the successful party’s attorneys’ fees after the arbitration or litigation proceedings conclude. A small minority of franchise agreements are non-reciprocal and do not require the franchisor to pay the franchisee’s attorneys’ fees if the franchisee is the successful party in dispute resolution proceedings.

(k) Required Purchases

Franchisors typically require franchisees to purchase from the franchisor or its approved suppliers all, substantially all, or part of the products, inventory, equipment, items, or supplies used in or sold by the franchisee in the franchised business.

ii. The Key FDD Items and Disclosures

Each area of disclosure is referred to in the FDD as an “Item” and there are 23 different items in the FDD. Significant areas of disclosure in the FDD include (most of the provisions above include the FDD reference):

- Fee disclosures (Item 6).

- an estimate of the initial investment that is required for the franchisee to build, open, and begin operating the franchise (Item 7).

- The prior business experience of the franchisor, its affiliates, and the officers, managers, directors, and other key employees who have management responsibility relating to the franchise (Item 2).

- The litigation and bankruptcy history of the franchisor and its officers, managers, directors, and other key employees who have management responsibility relating to the franchise (Item 3).

- Whether the franchisor offers the franchisee an exclusive territory and a description of any limitations on the scope of the franchisee’s territorial rights, including any rights the franchisor retains in the franchisee’s territory (Item 12).

- A description of the types of initial and ongoing assistance, including a summary of training, that the franchisor agrees to provide to the franchisee (Item 11).

- A list of any restrictions on the types of products, services, inventory items, equipment, real estate, or other items that the franchisee must purchase from the franchisor, its affiliates, or approved suppliers (Item 8).

- The franchisor’s financial statements, which must be audited by an independent certified public accountant (Item 21/Exhibit).

- A list of the existing franchised and company-owned units in the franchisor’s national system and information regarding the history of those locations over the franchisor’s previous three fiscal years (Item 20/Exhibit).

Financial Performance Representations (Item 19 Disclosure)

- The most troublesome and commonly litigated disclosure point is the financial performance representation. Financial performance representations take a variety of forms and include any statement (express or implied) that promises that the prospective franchisee can achieve a specific financial goal under the franchise regarding:

- Potential sales.

- Income.

- Gross profits.

- Net profits.

The financial performance representations disclosure is the only disclosure that is optional for franchisors. A franchisor can choose not to make any financial performance representations, but if it does not, it:

- Must include a clear and conspicuous statement in the FDD that it has elected not to make that disclosure. The FTC included this requirement to help mitigate the common misstatement by franchisor salespeople that federal law prohibits franchisors from making financial performance representations.

- Is prohibited from making any statement, whether in the FDD or otherwise, about the sales, income, or profits that the franchisee can expect to achieve, including implied earnings claims, such as:

- “you will be able to replace your current income by working at your franchise”;

- “you will earn enough money to buy a new sports car”; or

- “100% return on investment within the first year of operation.”

- Mere puffery, however, like “earn big money” or “this is the opportunity of a lifetime” generally does not constitute a financial performance representation.

If a franchisor does not make a financial performance representation in its FDD, prospective franchisees can ask existing and former franchisees in the system (listed under Item 20 of the FDD) for information regarding their own historical performance. Franchisees are generally not subject to the same restrictions against sharing their own financial information as the franchisor.

FranchiseHOW has provided this article for general informational purposes only. It is not intended as professional counsel and should not be used in that manner. You should contact your attorney to obtain advice with respect to any particular legal issue or problem.

You may like

Are you gearing up for a new business in 2024? Forget the next big tech start-up -the latest trend in town might be a perfectly toasted baguette. Take Paris Banh Mi Cafe and Bakery, for instance. This Vietnamese sandwich shop is rapidly growing, with locations popping up from coast to coast, from California to Florida.

But what’s the secret behind their success? Explore why the Paris Banh Mi franchise has snowballed in the last two years and be inspired to start your own business .

About Paris Banh Mi

The French baguette was introduced in Vietnam in the mid-19th century when the country was still a part of French Indochina. In the 1950s, Saigon saw the birth of a unique Vietnamese sandwich, “bánh mì,” which quickly became a favorite food of a large part of the population.

The story of Paris Banh Mi started in Orlando, Florida, at 1021 E Colonial Drive in 2019. Hien Tran and Doan Nguyen, a married couple passionate about food, opened the first Paris Banh Mi location. Their concept was simple: bring the delicious flavors of Vietnamese banh mi sandwiches, traditionally baguettes filled with savory meats and pickled vegetables, to a broader audience.

The customers quickly fell in love with the fresh ingredients, bold flavors, and convenient fast-casual setting. Now, Paris Banh Mi Cafe and Bakery promises to bring their customers the best “Baguette Banh Mi” taste.

In just two years, the laid-back cafe and bakery in Florida multiplied into a chain of stores in the county. Today, Paris Banh Mi is serving customers in 46 locations all across the USA. The company plans to expand to 100+ locations by 2026.

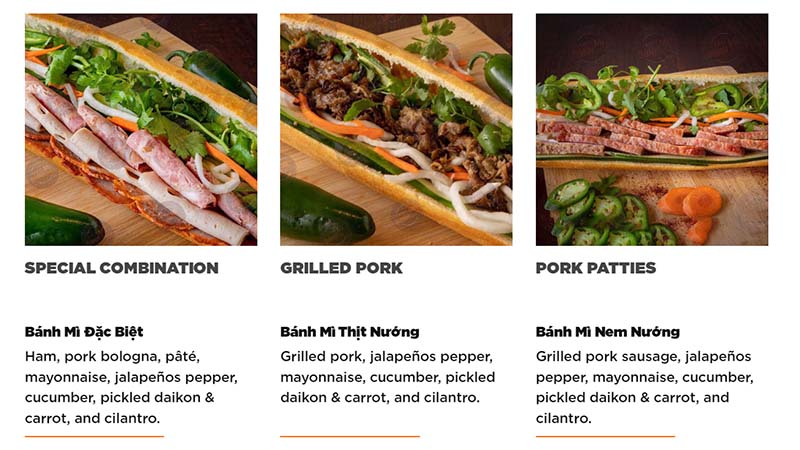

Each Paris Banh Mi Cafe and Bakery has a clean and spacious dining area, fast service, friendly staff, and a selection of delicious food and pastries. Take a peek at some of their mouth-watering baguette sandwiches filled with authentic Vietnamese ingredients.

Source: Paris Banh Mi website

For those craving something sweet, the bakery indulges you with a variety of French pastries. Check out their sandwiches, pastries, and beverages on the Paris Banh Mi Cafe and Bakery menu page.

Source: Paris Banh Mi website

Why Own a Paris Banh Mi Franchise

Paris Banh Mi is a franchised quick-service restaurant offering exciting opportunities for aspiring business owners. Many nail salon owners and aspiring entrepreneurs are switching to buying a Paris Banh Mi franchise. The main reasons why they love Paris are:

- It opens a great opportunity and is more profitable.

- Seamless franchising process and fewer things to worry about

- Required low capital to open

- Higher end-of-year profits

The benefits extend beyond operational efficiency. Paris Banh Mi boasts a surprisingly low-cost entry point compared to other franchises.

The initial franchise fee is manageable at $60,000. The total investment for opening a Paris Banh Mi can range from $200,000 to $500,000. This amount reflects the option to acquire a pre-existing, equipped location (second generation) for a lower investment cost or a complete build-out from scratch option.

Regardless of the chosen route, the investment is significantly lower than that of building a business from the ground up, making Paris Banh Mi an attractive option for many entrepreneurs.

Licensing Information

Owning a Paris Banh Mi franchise is not just about delicious food! The company is looking for dedicated individuals who can run their restaurant full-time. They will provide a multi-day training program for new franchisees. In addition, Paris Banh Mi offers ongoing support for franchisees, guiding them to make informed decisions and thrive in this exciting industry.

You’re a good fit for a Paris Banh Mi Cafe Bakery franchise if you are:

- Passionate about food, especially fresh baguettes and pastries

- A self-starter with a proven track record in business

- Financially responsible with a focus on results

- Ready to fully commit to building the Paris Banh Mi brand

If you have what it takes, don’t hesitate to contact them through the franchise hotlines on their franchise opportunities page.

Conclusion

Buying a restaurant franchise is one of the most attractive routes in the world of franchising. Paris Banh Mi makes owning your own business a lot easier. Forget the high costs and headaches of starting from scratch. Their low investment and comprehensive training program mean you can be your own boss with a delicious product. If you are ready to take a bite out of success, contact Paris Banh Mi today!

How To's

Chick-fil-A Franchising Opportunities in 2024

Published

2 years agoon

March 14, 2024By

Dan Wesson

Buying a franchise from Chick-fil-A is an excellent money-making and healthy option. The fast-food chain has been serving hungry consumers the most delicious chicken sandwiches unmatched by other fast-food restaurants. Buying a Chick-fil-A franchise means investing in a good business and your future. It also lets you continue the culture behind the popular food chain. Here are Chick-fil-A franchising opportunities that will give you entrepreneurial freedom in 2024.

Company Overview

Founded in 1946 by Truett Cathy, Chick-fil-A is deemed one of the longest-running chicken sandwich chains in the United States. The founder opened his first chain in Hapeville, Georgia, and has become a favorite soul food for many. Truett had worked in restaurants seven times a week and knew the importance of rest. That’s why he vowed to close Chick-fil-A every Sunday. He values rest and worship, so he sets aside one day of the week for his employees—a practice that Chick-fil-A still upholds today.

Chick-fil-A also selects franchisees that uphold their values and passion. The company takes great care in selecting who they do business with, which includes getting to know candidates through a lengthy and intensive selection process. The founder’s vision is to influence the people and communities they serve. Chick-fil-A also seeks franchise candidates in Puerto Rico, Canada, and the United States.

Chick-Fil-A candidates are required to show personal financial integrity and stewardship. They also need to have proven experience in leadership and a strong business acumen. Chick-fil-A ensures that candidates showcase entrepreneurial spirit, a strong character, and a growth mindset. This is to uphold the vision and values that Truett started in 1946.

Franchise Training Details

- The initial on-site training programs last three to four weeks. However, the duration and actual location of the training will vary.

- The training program primarily covers operational aspects, such as food preparation, service, customer relations, accounting, communications, purchasing, planning, maintenance, policies, management styles, and marketing.

- The franchisor may require franchisees to attend various conferences and seminars occasionally. This is on top of the initial training program.

- The franchisor may also offer various programs that operators can use in advertising products or hiring staff, which aren’t stipulated in the Franchise Agreement.

Franchise Territory

- The franchisor will grant franchisees one Chick-fil-A restaurant at the franchisor’s designated location.

- Franchisees will not get exclusive or protected territory, so they may face competition from other operators.

Franchise Obligations and Conditions

- Franchisees must devote their time and effort 100% to operating their Chick-fil-A restaurant.

- The franchisor only allows franchisees to sell products approved by Chick-fil-A. This also applies to franchisees with a Chick-fil-A-associated food truck.

Franchise Term and Renewal

The franchise term expires on early December 31, the year the agreement is signed or whatever the lease expiration is. Franchisees may apply for one-year extensions unless written notice is given 30 days before the franchise term expires.

Financial Assistance

- The franchisor designates locations, leases, and subleases the store’s premises to franchisees. The lease and sublease terms will vary depending on the type of Chick-fil-A restaurant and location.

- The franchisor also engages in concession agreements that oversee the utilization of non-traditional satellite unit locations with the proprietors or administrators of said satellite unit spaces.

- The franchisor offers extended payment periods for specific pre-opening costs stipulated in the Franchise Agreement. Additionally, the franchisor leases equipment to operators, charging a monthly rental fee based on the fair market rental value established by Chick-fil-A using its singular and exclusive business judgment. It’s important to note that neither the franchisor nor any affiliated entities provide any financing arrangements to operators, either directly or indirectly.

Did You Know?

Here are some fun facts about Chick-fil-A you need to know!

- Did you know that Chick-fil-A only uses peanut oil for frying? That’s what makes the chicken its unique flavor! Chick-fil-A is also the single most significant purchaser of peanut oil in the United States. They also believe peanut oil is a healthier option.

- The best Chick-fil-A promotional gig was the “First 100,” where the first 100 customers inside a new Chick-fil-A restaurant would get free chicken for a year.

- Did you know that the founder, Truett Cathy, invented the chicken sandwich? He worked for a restaurant in Atlanta, and the newly delivered chicken breasts were too big to serve as airline food. He turned this into a meal for the staff.

- You can get a free ice cream cone by walking up to the counter and trading your toy when ordering the kid’s meal.

Franchise Cost

Your Investment

| Name of Fee | Low | High |

|---|---|---|

| Initial Franchise Fee | $10,000 | $10,000 |

| Opening Inventory | $13,500 | $140,000 |

| First Month’s Rental of Equipment | $750 | $5,000 |

| First Month’s Lease/Sublease of Premises | $2,550 | $85,500 |

| First Month’s Insurance Expense | $240 | $12,000 |

| Additional Funds | $491,345 | $2,550,935 |

| ESTIMATED TOTAL | $518,385 | $2,803,435 |

Other Fees

| Type of Fee | Amount |

|---|---|

| Advertising | May vary (a) between 0% to 3.25%, to be determined by Chick-fil-A, as a percentage of gross receipts or (b) by vote of operators in local or regional areas. |

| Advertising Support and Services Fee | Advertising support and services fees incurred, if any, will vary based upon the support and services offered by the franchisor, and selected and received by the operator; the current in-house blended hourly rate for services is $100; Operator will pay any additional fees, costs and expenses as applicable. |

| Additional Franchise Fee | $5,000 for each additional Chick-fil-A restaurant business. |

| Business Services Fee | $300 (monthly). |

| Rent (Traditional Restaurant) | $2,550 to $85,500 (including where applicable, percentage rent). |

| Occupancy Charge (Satellite Unit) | Determined under the concession agreement attached as an exhibit to the concession sublicense agreement; currently estimated to range between 4% and 30% of gross receipts. |

| Food Truck Usage Fee (Food Truck) | Currently $2,100 to $3,100, plus additional fees, costs and expenses. |

| Food Truck Insurance Fee (Food Truck) | Currently $250 to $450 (monthly). |

| Insurance | $240 to $12,000 (monthly). |

| Equipment Rental | Currently $750 to $5,000 (monthly). |

| Hardware and Software Support; High-Speed Internet Access | $9,500 to $20,000 (annually). |

| Fines – Minimum Standards and Procedures | Will vary under the circumstances. |

| Indemnification | Will vary under the circumstances. |

| Operating Service Charges | Determined by formula. |

| Credit Cards Fees and Related Processing Fees | Will vary. |

| Highway Signage | Will vary under circumstances. |

| Interest on Late Payments | The maximum rate permitted by law, or if none, 1.25% per month. |

| Cash Handling System Services | $85 to $450 (monthly) |

| Reimbursement of Cost of Performance | Costs and expenses of performance. |

| Holdover Liquidated Damages | Double the base rent and percentage rent. |

Here are the Chick-fil-A franchise costs:

If you’re looking for another investment opportunity, visit Franchise How’s website for more information.

How To's

Zoom Sewer and Drain Cleaning Franchise Cost

Published

2 years agoon

March 12, 2024By

Dan Wesson

Taking care of your home’s plumbing system is an essential part of being a homeowner. However, not everyone has the skill and patience to do it, and so franchises such as Zoom Sewer and Drain Cleaning are some of the most lucrative. Here’s what you need to know if you’re thinking of getting it:

Franchise Description

Zoom Sewer and Drain Cleaning provides drain cleaning, maintenance, sewer inspections, repair and replacement services for residential and commercial customers. The business began in 1995 and had been franchising since 2013. They have their headquarters in Norristown, Pennsylvania, and Zoom Franchise Company, LLC is the franchisor.

Training

Training for the franchisee’s principal owner and personnel will be provided by the franchisor or its representatives and agents. Before starting your franchise, Zoom Sewer and Drain Cleaning will require you to complete their training program. It comes in two phases:

- Phase 1: 2 to 3 days training at the Franchise Business

- Phase2: 2 to 3 days in Norristown, PA

The franchisor may also require you to attend additional training during the length of your term agreement. The franchisor is planning to hold a 2 to 3-day national Zoom Fest yearly. This will be held in Norristown, PA, or any location it designates. They will require franchisees to attend, but their managers will be welcome.

Territory

The franchisor will designate a protected territory where the franchisees will operate their business. Before signing any Franchise Agreement, both the franchisor and the franchisee will agree on a geographic territory.

The franchisor will base the protected territory on contiguous zip codes that will consist of approximately 500,000 individuals. This will be based on the most recent U.S. Census data at the time of signing the franchise agreement. This means that as long as the deal is taking effect, the franchisor or its affiliates will not locate, operate, or grant a franchise for another Zoom Sewer and Drain Cleaning business within the protected territory.

Obligations

The franchisor requires the franchisee or its principal owner to exert every effort to take responsibility for the management of the business. They will do this on a daily basis unless they agree on an alternate arrangement. With the franchisor’s discretion, the franchisee can hire a manager to handle the operations of the business.

Franchisors will also require you to sell products and services that have their approval. On the other hand, franchisees aren’t allowed to sell unauthorized products or services in compliance with the franchise agreement. Franchisees are also not allowed to solicit business outside of the protected territory. They are, however, permitted to serve customers outside of the protected territory as written in the FDD.

Term of Agreement

The initial franchise will take ten years after the signing of the agreement. You can renew the contract for another ten years, for four times, if you continue to meet the requirements.

Financial Assistance

Zoom Sewer and Drain Cleaning doesn’t offer direct or indirect financial assistance to its franchisees. In addition, they will not guarantee a franchisee’s note, lease, or obligation.

Did You Know?

Get to know more about Zoom Sewer and Drain Cleaning before you get that franchise. Here are some facts about the business:

- They have very little competition in the niche. Most of their competitors are independent plumbers and contractors

- According to the company’s co-founder and COO, Ellen Rohr, this is a recession-resistant business, and the Covid-19 pandemic has proven this

- They have a reported $12 million in revenue with 53 employees and 15 franchisees

Your Investment

The table below shows the estimated cost of a Zoom Sewer and Drain Cleaning franchise. Take note that these numbers may change without any prior notice.

| Name of Fee | Low | High |

|---|---|---|

| Initial Franchise Fee | $35,000 | $35,000 |

| Lease | $3,000 | $9,000 |

| Leasehold Improvement | $2,000 | $40,000 |

| Furniture, Fixtures and Computer System | $7,500 | $13,000 |

| Vehicles | $7,000 | $9,500 |

| Vehicle Wrap and Design | $4,500 | $5,500 |

| Initial Equipment and Inventory of Supplies | $40,000 | $50,000 |

| Business Licenses and Permits; Deposits and Pre-Paid Expenses | $0 | $5,000 |

| Professional Fees | $500 | $3,000 |

| Insurance – Quarterly | $4,000 | $6,000 |

| Initial Training Expenses | $500 | $3,000 |

| Initial Marketing Expenses | $45,000 | $60,000 |

| Additional Funds – 6 months | $50,000 | $100,000 |

| ESTIMATED TOTAL | $199,000 | $341,000 |

Other Costs

| Type of Fee | Amount |

|---|---|

| Royalty Fee | 5% of Net Sales. |

| Marketing Fee | Up to 2% of Net Sales. Currently, the franchisor does not charge this fee. |

| Call Center Fee | Up to $25 per scheduled appointment. Currently, the franchisor does not operate the Call Center or charge a Call Center Fee. |

| Technology Fee | The then-current Technology Fee; currently $500 per month. |

| Webpage Development and Optimization Fee | The then-current fee charged by the franchisor’s designated website SEO provider; currently $695 per month. |

| Additional Location Fee | The then-current Additional Location Fee; currently $2,000. |

| Transfer Fee | Up to 50% of the then-current Initial Franchise Fee. |

| Renewal Fee | Up to 25% of the then-current Initial Franchise Fee. |

| Additional Training and Assistance | Fee and all expenses. Currently $1,000 per day plus travel expenses. |

| National Conference | Reasonable fees and all expenses. |

| Testing for Supplier Approval | Reasonable fee. |

| Interest on Late Payments | Lesser of 1.5% per month or maximum legal rate. |

| Audit Fee | Cost of audit. |

| Taxes | Actual cost. |

| Indemnification | Will vary under circumstances. |

| Costs and Attorneys’ Fees | Will vary under circumstances. |

For other franchising information, check out more articles here at Franchise How!

The Rise of Paris Banh Mi Franchise

Chick-fil-A Franchising Opportunities in 2024

Insider Interviews: Craig Batiste Co-Founder and CEO of Mr. Fries Man

Want To Own A Hertz Franchise? Here’s How Much It Will Cost You

The Top 8 Most Expensive Franchises to Buy